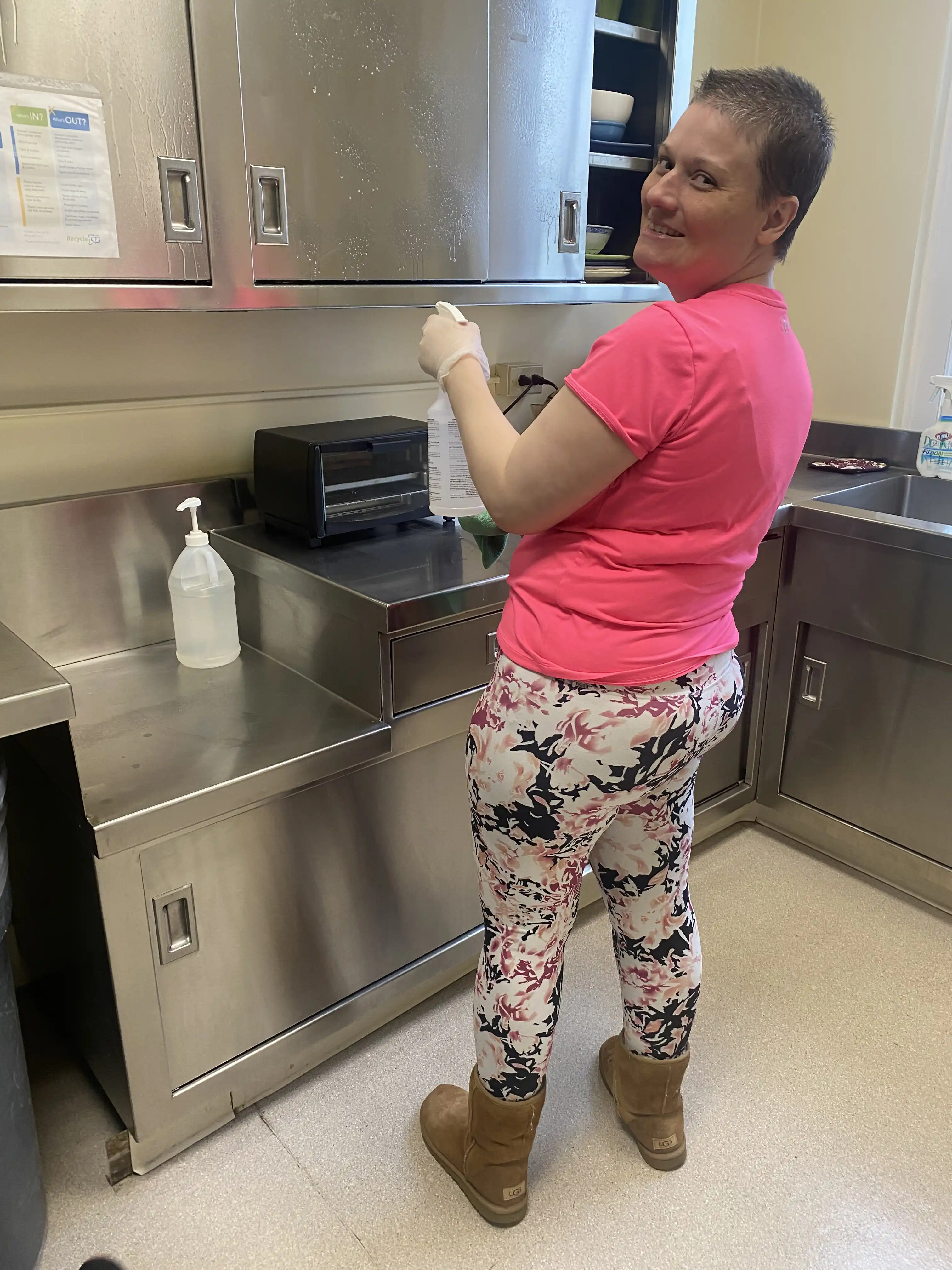

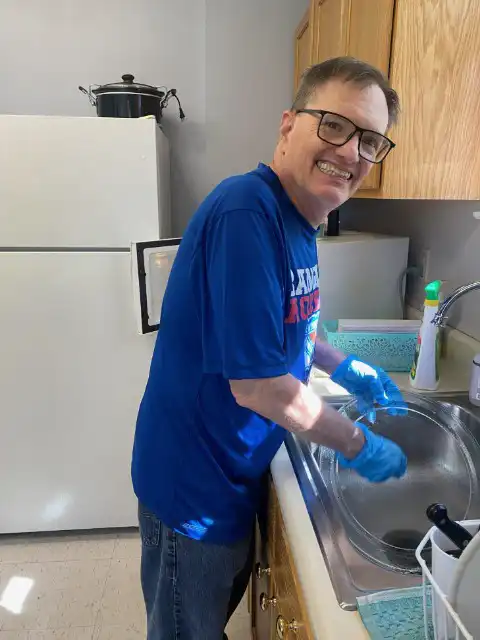

The most helpful way to help is by making a 100% tax deductible cash donation.![]()

Your gift can help Kuhn enable individuals with disabilities to experience their vocational potential and achieve their employment goals. A gift of any size is appreciated.

Make a Donation to Kuhn Now:

- Use our secure online form

- Contact us at (203) 235-2583 or (860) 347-5843

Your tax deductible contribution will be greatly appreciated.